Подборка по базе: ЭМ 102 пример выполнений ПЗ.docx, Инструкция по выполнению лабораторных работ.docx, Аня. ИТ 3 тест 87 баллов.pdf, Технология выполнения работ .docx, Файл для выполнения самостоятельной работы по теме 1_3.docx, Приложение 1. Шаблон для выполнения КР Региональная экономика.p, курсовая работа на тему _Формирование алгоритмического навыка пр, Методические рекомендации по выполнению курс проекта — 2018.docx, Бланк выполнения задания 5.docx, Метод для выполнения Конт.раб. Основы делопроизводства заочное.d

Вопрос 1

Выполнен

Баллов: 0,00 из 1,00

Текст вопроса

Cash flow идеи показывает:

Выберите один ответ:

Вопрос 2

Выполнен

Баллов: 1,00 из 1,00

Текст вопроса

Бизнес-модель проектного менеджмента Google это:

Выберите один ответ:

Вопрос 3

Выполнен

Баллов: 0,00 из 1,00

Текст вопроса

Бизнес-модель, ориентированная на взаимоотношении с внешним рыночным окружением это:

Выберите один ответ:

Вопрос 4

Выполнен

Баллов: 1,00 из 1,00

Текст вопроса

Бизнес-модель, ориентированная на процессы внутри организации, это:

Выберите один ответ:

Вопрос 5

Выполнен

Баллов: 1,00 из 1,00

Текст вопроса

В зависимости от отношения к собственности источники инвестиций подразделяются на следующие виды:

Выберите один или несколько ответов:

Вопрос 6

Выполнен

Баллов: 1,00 из 1,00

Текст вопроса

В каком инструменте проектного менеджмента интепретируется инструмент бизнес-модели:

Выберите один ответ:

Вопрос 7

Выполнен

Баллов: 0,00 из 1,00

Текст вопроса

Видом рентабельности идеи может быть:

Выберите один ответ:

Google, основанная в 1998 году, является гигантской технологической корпорацией из США. Помимо своей основной идентичности в качестве поисковой системы, он также является специалистом в области продуктов и услуг, связанных с Интернетом.

Бизнес-модель Google — крупнейшей поисковой системы — вращается вокруг поисковой системы, интернет-рекламы, облачных вычислений, аппаратного и программного обеспечения. В этом посте мы расскажем об интригах бизнес-модели Google и попытаемся понять, как Google генерирует свои доходы. Итак, давайте разгадаем тайну здесь и сейчас.

Для тех, кто является постоянными пользователями интернета, Google — это довольно распространенный сайт. Просто нет ни малейшего сомнения в том, что Google является самым важным и популярным сайтом во всем мире.

Компания сумела закрепиться на верхней позиции в списке лучших сайтов мира.

Мало того, что это одна из самых популярных поисковых систем.

Таким образом, нет никаких сомнений в том, что у такой компании, как Google, будет отличная бизнес-модель. Бизнес-модель такой компании, как Google, действительно будет источником вдохновения и полезна для других компаний, которые хотят создать бизнес- стратегию, которую сделал Google.

Различные отрасли, охватываемые бизнес-моделью Google,

- интернет

- Компьютерное программное обеспечение

- Облачные вычисления

- реклама

- Искусственный интеллект

- Компьютерное железо

Сеть продуктов, услуг, приобретений и партнерских отношений, предлагаемых Google,

- Поисковая система Google

- Документы Google, Google Sheets и Google Slides

- Gmail / Входящие, Календарь Google, Google Диск

- Google All, Duo и Hangouts для обмена мгновенными сообщениями

- Google Translate для языкового перевода

- Карты Google, Waze, Google Планета Земля, Street View для картографии и навигации

- YouTube для обмена видео и Google Keep для ведения заметок

- Google Фото, мобильная ОС Android , браузер Google Chrome, ОС Chrome

- Устройства Nexus, смартфон Google Pixel, динамик Google Smart Home, беспроводной WiFi-маршрутизатор Google WiFi

- Гарнитура виртуальной реальности Google Daydream

- Google Fiber, Google Fi и Google Station

Чтобы понять бизнес-модель Google, вам нужно пройтись по различным сегментам бизнес-модели Google и углубиться в продукты этих сегментов.

Различные сегменты и связанные продукты бизнес-модели Google

Распределение бизнеса по Google связано с разными сегментами. Теперь мы рассмотрим эти сегменты по одному:

# 1. Сегмент поисковой системы

Это самый важный сегмент бизнеса Google, который также играет наиболее важную роль, помогая Google получать хорошие доходы. Другой продукт этого сегмента

- Поиск Гугл

- Google Книги

- Google Фото

- Специальный поиск

Бизнес-модель Uber — Как Uber зарабатывает деньги?

# 2. Рекламный сегмент

Реклама очень важна для того, чтобы помочь бизнес-модели Google генерировать хорошие доходы. Это позволяет компаниям, маркетологам и рекламодателям размещать объявления в Google, за которые они платят Google фиксированную сумму. Некоторые продукты, которые входят в этот сегмент,

- Google AdWords

- Гугл Аналитика

- Google AdSense

- Google Ad Mob

# 3. Сегмент корпоративного продукта

Ключевые продукты этого сегмента-

- Google Search Appliance

- Google Apps

# 4. Сегмент инструментов повышения производительности

Google также предлагает некоторые из наиболее полезных инструментов повышения производительности для своих потребителей. Давайте посмотрим на них, а также

- Gmail

- Гугл Диск

- Google Doc

- Google Code

- Календарь Google

# 5. Дополнительные продукты

- Новости Google

- Google телефоны и ОС Android

- Google Fiber

- Google Goggles

- Гугл Хром

Теперь, когда вы хорошо знаете, что бизнес-модель Google направляет для обслуживания своей клиентской базы, пришло время понять, как Google зарабатывает деньги.

Как Google зарабатывает деньги? | Бизнес-модель Google

Поисковые запросы в Google растут с каждым днем, и более 1 триллиона таких поисков выполняется на платформе Google каждый день.

Таким образом, нет никаких сомнений в том, что это один из самых удивительных сайтов в мире, который используется более чем 90% людей , которые используют Интернет наилучшим образом.

Следовательно, мы собираемся немного поговорить об этом наверняка.

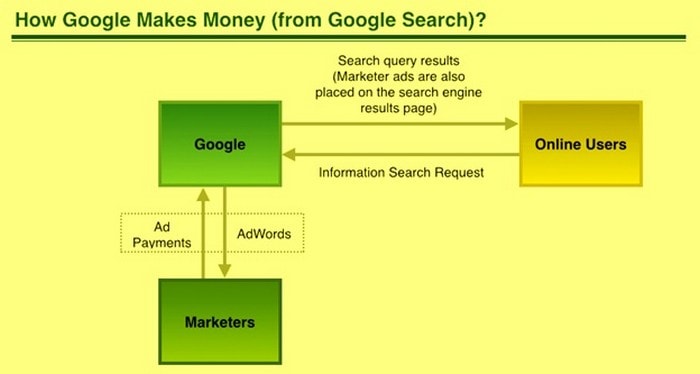

Давайте посмотрим, как поиск Google помогает Google зарабатывать деньги с помощью изображения ниже —

Пользователи отправляют запрос на поиск в Google, а затем Google предоставляет соответствующие результаты.

Теперь маркетологи и компании используют эту систему для показа своих объявлений с помощью AdWords путем оплаты в Google, чтобы их продукты и услуги могли получать релевантные результаты поиска в качестве ответа / решения для запроса пользователя.

Это факт, что Google получает большую часть денег от рекламы наилучшим образом, поэтому сначала; мы поймем, что

Как реклама может помочь Google в зарабатывании денег? Бизнес-модель Google

Когда дело доходит до рекламных объявлений, которые находятся в Google в большинстве случаев, можно сказать одно.

Они очень помогают, когда дело доходит до получения дохода наилучшим образом. Тем не менее, для рекламы есть три различных компонента, которые, безусловно, очень помогают.

Ну, это AdWords, AdMob и AdSense.

Нет сомнений в том, что без этих трех компонентов Google не сможет рекламировать наилучшим образом. Теперь есть разные задачи для каждого из компонентов, которые упомянуты здесь.

Например, Google AdWords — это то, что может рассматриваться как целевая платформа для рекламодателей, которые хотят разрабатывать, а также наилучшим образом запускать определенные кампании от имени Google Engine.

Рекламные объявления, которые будут отображаться в Интернете, выбираются с помощью Google AdWords. Таким образом, можно сказать, что это один из самых важных и удивительных компонентов для рекламы Google в лучшем виде.

Бизнес-модель Walmart — Как Walmart зарабатывает деньги?

Теперь, когда мы приходим в AdSense, есть только одна вещь, чтобы сказать. Этот компонент в основном ориентирован на издателей, и это платформа, которую могут использовать издатели со всего мира, которые хотят заработать немного денег, размещая свою рекламу на своих веб-сайтах.

Так что просто нет ни малейших сомнений в том, что они смогут быть частью важной контекстно-медийной сети Google наилучшим образом. Теперь, кто бы не хотел быть частью этого, верно?

Теперь мы подошли к последнему из компонентов, и он известен как AdMob. Ну, это один из компонентов, который имеет те же свойства, что и AdSense. Однако между этими двумя вариантами есть некоторая разница, и именно в этом AdMob можно использовать для мобильных платформ.

Мы здесь, чтобы сказать вам, что с помощью этих двух удивительных компонентов просто нет никаких сомнений в том, что Google сможет создавать удивительные рекламные объявления, которые станут лучшей помощью, необходимой для получения денег.

Google Shopping Ads: что нужно знать об этом

Это еще один компонент бизнес-модели Google. Есть так много разных типов рекламы, что Google имеет в первую очередь. Таким образом, мы можем сказать это без каких-либо сомнений в том, что людям необходимо знать о некоторых из этих рекламных объявлений, чтобы они могли иметь представление о том, что Google может зарабатывать деньги с помощью этих удивительных рекламных объявлений наверняка.

Поисковая система — это то, что наилучшим образом использует потрясающую рекламу Google Shopping. Это объявления, которые очень полезны, когда дело доходит до выбора удивительных целевых клиентов и покупателей, которые будут впечатлены тем форматом рекламы, который есть в рекламе Google Shopping.

Таким образом, мы можем сказать это без сомнения, что это будет лучшим решением для компании Google для получения некоторого дохода наилучшим образом.

Мы здесь, чтобы сообщить вам, что эти торговые объявления в Google являются одним из основных источников удивительного дохода, который компания получила в первую очередь. Конечно, есть и другие варианты, но это один из главных факторов.

Доход, полученный от Google Maps

Это, безусловно, один из самых важных факторов, которые в значительной степени способствуют доходу, который, безусловно, генерирует Google. Есть Google Maps, которые используются пользователями, которые хотят иметь некоторые направления из одного места в другое.

Существует довольно большая база пользователей для удивительных карт Google, и она получает удивительный доход от API, который особенно используется такими компаниями, как Trivago, Uber , Pokemon Go и многими другими.

Продукт ценообразования , который платит пользователям будут направлены компании наилучшим образом. Следовательно, это факт, что Google Maps является одним из крупнейших источников дохода для компании Google. Это то, что люди всегда должны помнить наверняка.

Бизнес-модель Xiaomi — Как Xiaomi зарабатывает деньги?

Доход от Google Translate | Бизнес-модель Google

Мы немного поговорили о Google Картах, и точно так же есть еще одно замечательное приложение, которое называется Google Translate, и еще одно бесплатное приложение, которое пользователи могут использовать для перевода практически чего угодно.

Несмотря на то, что приложение бесплатное, нет никаких сомнений в том, что это приложение, которое может заработать много денег для компании Google.

Причиной этого является то, что компании и замечательные люди постоянно используют приложение Google Translate, а имеющаяся интеграция API может помочь ему наилучшим образом зарабатывать деньги.

Так что это одна из самых важных вещей, которые люди должны иметь в виду о Google Translate наверняка.

Доход, полученный от G Suite

Вот еще один вариант для компании Google, из которого она может заработать много денег наверняка. G Suite — это то, что в лучшем случае можно считать удивительным брендом облачной производительности.

В G Suite предусмотрены коллективные инструменты для совместной работы, такие как документы, видеовстречи, Gmail, календарь, диск, листы, сайты и многое другое, причем самым удивительным образом. Бренд будет работать по бизнес-модели, которая наверняка будет свободной.

Пользователь сможет получить облачное пространство с ограниченными возможностями, а предоставляемые функции в значительной степени бесплатны до тех пор, пока пользователь не захочет выполнить обновление, и за это ему придется заплатить, чтобы он мог использовать его для своего бизнеса в лучший путь. Так что это также один из способов, которыми Google может зарабатывать деньги.

Завершение!

В конце мы хотели бы сказать, что бизнес-модель и модель доходов компании Google наверняка зависят от множества факторов.

Помимо упомянутых выше вариантов, существует множество других способов, с помощью которых Google может наилучшим образом заработать деньги, таких как Google Chrome, Google Play Store и другие важные приложения и методы.

Следовательно, нет никаких сомнений в том, что люди должны знать все больше и больше о бизнес-модели Google наверняка. Итак, мы надеемся, что эта статья будет для вас информативной.

Бизнес-модель Google

Сердце бизнес-модели Google — ценностное предложение для рекламодателей: целевая текстовая реклама в Интернете, доступная пользователям всего мира. С помощью AdWords рекламодатели могут размещать рекламу и ссылки на поисковых страницах Google (а также в других партнерских сетях). При использовании поиска Google реклама показывается на каждой странице параллельно с результатами поиска. Google гарантирует, что на страницах будет только та реклама, которая имеет отношение к поисковому запросу. Этот сервис привлекателен для рекламодателей, потому что дает им возможность разрабатывать онлайн-кампании в соответствии с конкретными запросами и адресатами.

Однако такая модель работает только в том случае, если поиском Google пользуются многие. Чем больше пользователей обращается к поисковой системе, тем больше рекламы можно разместить и тем выше доходы рекламодателей. Ценностное предложение Google для рекламодателей в большой степени зависит от числа потребителей, которые пользуются этой поисковой системой. Поэтому Google предлагает второй группе потребителей мощный поисковый аппарат и постоянно увеличивающееся число инструментов, таких как Gmail (электронная почта), Google Марs или Picasa (онлайн-фотоальбом). Чтобы увеличить число потребителей, Google запустил сервис _AdSence](http://www.google.com/adsense/start/), который позволяет показывать его рекламу на сайтах, не относящихся к Google. Сервис дает возможность третьим сторонам получать часть рекламного дохода компании, демонстрируя на своих сайтах рекламу Google. AdSence автоматически анализирует содержимое сайта и показывает его посетителям релевантную текстовую и изобразительную рекламу. Ценностное предложение Google владельцам этих веб-сайтов — дополнительная возможность зарабатывать на своем контенте.

Модель многосторонней платформы Google весьма примечательна. Здесь доход приносит один потребительский сегмент — рекламодатели, в то же время два других сегмента, пользователи Интернета и владельцы контента, получают бесплатные предложения. Это логично, так как чем больше рекламы демонстрируется пользователям, тем больший доход можно получить от рекламодателей. В свою очередь увеличение прибыли от рекламы побуждает еще большее число владельцев контента становиться партнерами AdSence. Рекламодатели не покупают рекламное место непосредственно у Google. Они делают ставки на соответствующие ключевые слова, связанные либо с условиями поиска, либо с содержимым партнерских веб-сайтов. Ставки делаются через аукционный сервис AdWords: чем популярнее ключевое слово, тем большую сумму должен заплатить рекламодатель. Доход, который приносит AdWords, позволяет Google постоянно улучшать свои бесплатные предложения для пользователей поисковой системы и партнеров AdSence.

Ключевой ресурс Google — его поисковая платформа, которая поддерживает три разных сервиса: поиск по сети (Google.соm), рекламу (AdWords) и получение третьими сторонами прибыли с контента (AdSence). Эти сервисы основаны на сложных фирменных алгоритмах поиска и соответствия, поддерживаемых обширной ИТ-инфраструктурой. Ключевые виды активности Google можно определить как:

- построение и поддержание поисковой инфраструктуры;

- управление тремя основными службами и

- продвижение платформы к новым пользователям, владельцам контента и рекламодателям.

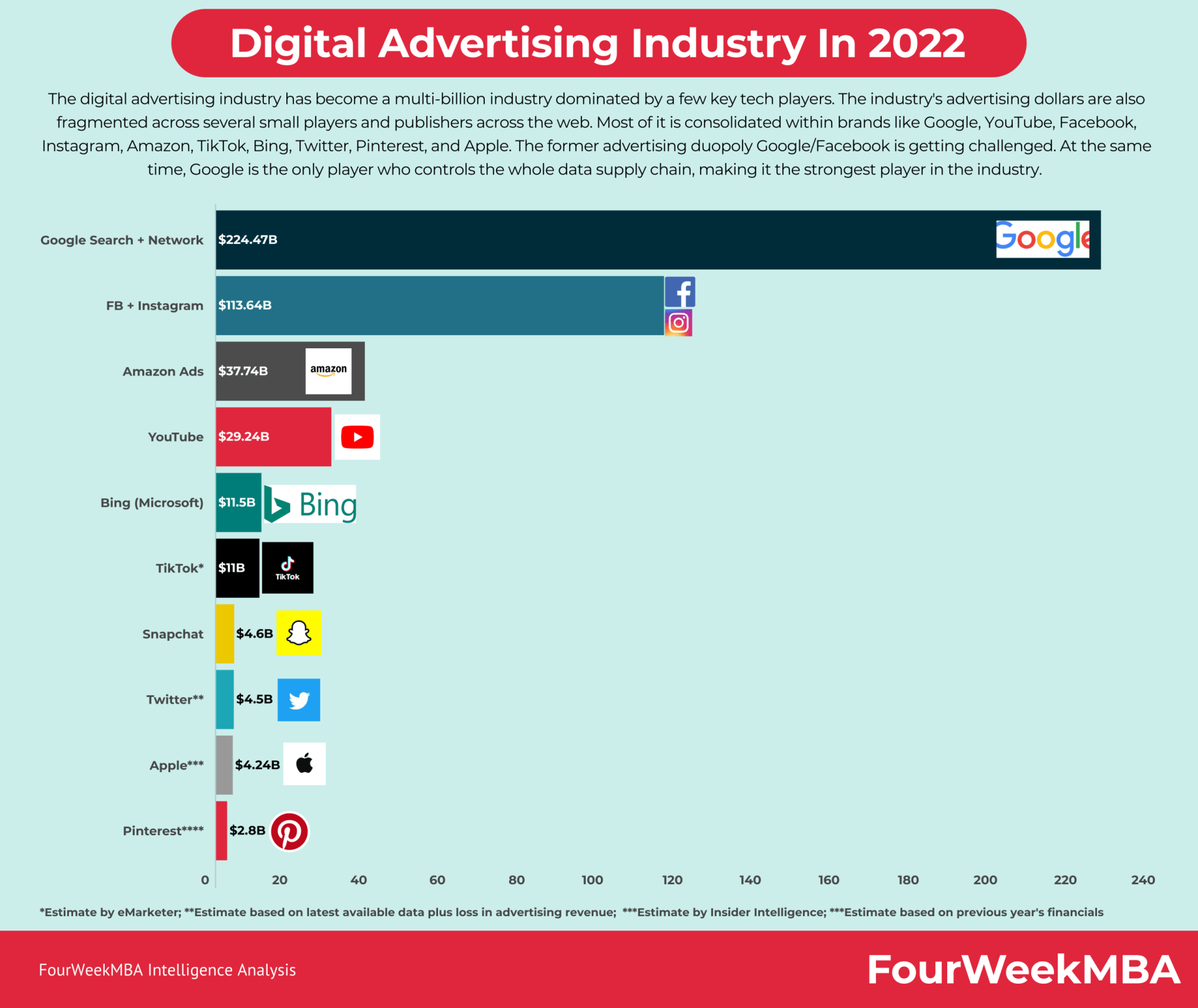

Google is an attention merchant that – in 2022 – generated over $224 billion (almost 80% of revenues) from ads (Google Search, YouTube Ads, and Network sites), followed by Google Play, Pixel phones, YouTube Premium (a $29 billion segment), and Google Cloud ($26.2 billion).

| Google Revenue Breakdown | 2022 |

| Google Search & other | $162.45B |

| Google Network Members |

$32,78B |

| YouTube ads | $29.24B |

| Google Other | $29B |

| Google Cloud | $26,28B |

| Other Bets |

$1B |

Google is a platform and a tech media company running an attention-based business model. As of 2021, Alphabet’s Google generated over $282 billion in revenues.

Over $224 billion (almost 80% of the total revenues) came from Google Advertising products (Google Search, YouTube Ads, and Network Members’ sites).

They were followed by over $29 billion in other revenues (comprising Google Play, Pixel phones, and YouTube Premium) and by Google Cloud, which generated over $26 billion in 2022.

While Google, now Alphabet, has been diversifying its business model for more than a decade. Its main revenue stream is Google’s search engine, which generated over $162 billion in revenue in 2022.

Followed by the network members’ websites (the sites that adhere to Google AdSense for a revenue share on top of the advertising revenues generated on their properties).

And YouTube Ads, which generated over $29 billion (this excludes YouTube Prime Memberships, which are comprised of the other revenues).

Among the bets which Alphabet has placed over the years, there are ventures in the self-driving industry, robotics, sustainable/renewable energies, and more!

| Key Facts | |

| Founders | Larry Page & Sergey Brin |

| Year & Place Founded | September 4, 1998, Menlo Park, CA |

| Initially Called | BackRub, in 1996 |

| Year of IPO | 8/19/2004 |

| IPO Price | $85.00 |

| Total Revenues at IPO | 961.8 million by 2003, prior to IPO |

| Name change | On October 2, 2015, Google became Alphabet, the parent company |

| Total Revenues in 2021 | $282.83 billion |

| Alphabet Employees | 190,234 full-time employees by 2022 |

| Revenues per Employee | $1.48 million per employee |

Google Business Model Short Description

We describe the Google business model via the VTDF framework developed by FourWeekMBA.

| Google Business Model | Description |

| Value Model: Business Productivity. |

Google’s mission statement is to “organize the world’s information and make it universally accessible and useful.” Alphabet’s main value model is built on top of offering a set of free tools for business productivity, from search to productivity apps (like Google Docs). |

| Technological Model: Platform, Ad Marketplace. |

Google is a platform business model, leveraging a free tool for search and an advertising marketplace for ads. |

| Distribution Model: Vertical Integration of Data. |

The company is vertically integrated by following each step of the data supply chain, from data harvesting to data repackaging and its exchange within Google’s proprietary advertising marketplaces. |

| Financial Model: Traffic Monetization Multiple. |

The company acquires traffic to its properties, through branding, deal-making, and a vertical supply chain. This traffic is monetized many times over into its advertising machine (in 2021, Google generated 4.6 times its traffic acquisition costs). |

Alphabet’s Google Business Model Today

Google’s Alphabet is one of the most successful tech players of our time.

While Alphabet is now a vertically integrated company that goes beyond Google’s search engine.

In reality, the Google search engine still plays a key role in the overall organization. In fact, Google is the main asset that provides resources to Alphabet to keep investing in new areas, keep integrating its supply chain, and also place bets in completely new and unrelated areas.

Google’s parent company, Alphabet, released its end-of-year financials. Looking at its financials is important for various reasons, some of which are:

- Assessing the digital advertising landscape.

- Understanding how Google’s advertising machine works at scale.

- How consumers’ behavior is shifting in this new digital landscape.

When Google IPOed in 2004, it recorded almost a billion in revenues, and it was worth about $23 billion, as it popped at its IPO date to $85 per share (On February 2nd, 2022, a Google stock is worth $2,958.22).

At the time, in 2004, Google had just managed to scale its advertising machine comprised mainly of Google AdWords (today Google Ads) and Google AdSense.

At the time the advertising machine was primarily based on Internet traffic from desktop devices. That was a completely different world.

As we’ll see throughout this analysis, today most traffic comes from mobile. And Google’s mobile ads platforms (Google AdMob) play a key role. So let’s dive a bit into the main financial segments of Google.

In 2022, the Google advertising machine generated over $224 billion in revenue.

Today the Google advertising machine is comprised of three main products:

- Google Search/Properties: This represents the set of products that Google owns, from the search engines to all the other vertical platforms that the company operates (Google Discover, Google News, Google Travel, and more). In 2021, this segment generated over $162 billion!

- YouTube: This is of course one of the most successful business acquisitions ever done. It was acquired by Google for $1.65 billion in 2006. It’s important to notice that Google was able to integrate YouTube and scale it up. A feat that not every other company would have been able to achieve. At the time YouTube was getting sued for various copyright infringements (the platform is comprised of user-generated content, often posting copyrighted materials) that would have most probably bankrupted it if it had stayed a startup without Google’s backing. By 2022, YouTube has become an advertising machine generating over $29 billion (this doesn’t count the YouTube memberships, which are reported separately).

- And Google Network Members’ properties: this is the set of publishers that decide to opt into Google’s advertising network (either AdSense for desktop, or AdMob for in-app advertising). Here Google shows advertising on the network members’ properties, thus splitting the revenues with them. In 2022, Google’s network members generated almost $33 billion of revenue.

As we’ll see understanding the difference among these segments helps us understand how Google manages its cost structure for each segment.

What determines the growth of each segment?

- Google’s search advertising has been driven by growth in search queries. In fact, since the pandemic hit, more and more users have started to use Google’s products. This trend has continued. However, most of it was driven by mobile users’ growth. This is an important aspect, as it shows that Google’s main driver of growth is based on mobile traffic. This changes the way the company needs to prioritize its product development efforts; its ad formats served to users, and also how it experiments.

- YouTube growth was driven primarily by improved ad formats. This means that Alphabet (as it’s evident to anyone going on YouTube) has ramped up its advertising operations on YouTube. In short, on YouTube, now there are way more ads than before. This “improved ad formats” is the result of YouTube’s extreme stickiness with users, which enables Alphabet to play with its ad formats.

- Google’s network members’ properties were primarily driven by AdMob. In short, the mobile advertising platform, powered up by Android devices through the Google Play store, was the main driver of revenue growth in 2021. This shows how Google has also shifted its focus to the mobile advertising platform.

The Google Advertising Machine

When it comes to Google, its cost structure is pretty straightforward. In order to keep its operations profitable, it needs to be able to generate traffic at much lower costs than it can monetize it.

In 2022, Google traffic acquisition costs were over $48 billion.

With respect to advertising revenues, its traffic acquisition costs were 22% of its advertising revenues in 2022.

This shows that a lot of that adoption was organic and based on strong deals the company has in place.

In terms of profitability, it’s interesting to notice how, at a wider scale, Google Services has huge margins. That’s because Google managed to improve monetization for users; it saw mobile users’ growth while it managed to lower its traffic acquisition costs!

This combination led to an improved marginality.

However, it’s also interesting to notice how the Google Advertising machine is the only one running at positive margins.

Where instead, both the Google Cloud platform and the other Google Bets run at negative margins. Important to distinguish here.

The Google Cloud Platform is critical for the future success of the Google AI platform.

When you look at a business model like that of Google, which is primarily a software/digital/tech company, it’s easy to fall into the trap of thinking it’s an asset-light business.

Indeed, a software company is asset-light compared to much more traditional industries (for instance, manufacturing), but they do have massive expenses to guarantee their distribution strategy.

In 2022, Google spent over $48 billion in traffic acquisition costs, which comprise costs incurred to cut distribution deals with other companies (like the multi-billion deal Google has to be the default search engine on Apple’s Safari), and many other deals, together with the money paid to partners to bring traffic back to the Google’s properties.

Now, keeping this number stable over time is critical to assessing the health of the advertising machine. In fact, on top of the traffic that Google generates, the company is able to monetize it many times over.

Thus, in 2022, Google spent over $48 billion in traffic acquisition costs, but it generated over $224 billion in advertising revenues.

This means that Google was able to monetize its traffic 4.6 times its traffic acquisition costs.

History of Google

In a paper entitled “The Anatomy of a Large-Scale Hypertextual Web Search Engine,” two P.h.D. students introduced the concept of indexing the growing number of pages on the Internet:

At the time, they didn’t like the advertising business model. Indeed, they highlighted: “We expect that advertising funded search engines will be inherently biased towards the advertisers and away from the needs of the consumers.“

So how did we get to the Google of today?

The birth of the PC standard, the commoditization of hardware, and software as a premium industry

Back in the early 1980s, IBM was looking for a way to break into the computer market. The key players in the computer space were Tandy, Commodore, and Apple, which by the late 1970s, controlled most of the market.

However, the computer market at the time was much small, more skewed toward business niches, and computers were still quite expensive.

IBM set out to change all that with an approach it had never experimented with before. IBM brought together a team of 12 technical people to work on a personal computer. A computer that could be sold at a low price point to make it scale to the masses.

However, rather than developing every single piece of the puzzle. IBM went for an open system approach. Where it lets other companies develop various parts of the personal computer.

Among these companies, in the early 1980s, IBM reached out to a young Bill Gates to create the operating system for its personal computers. This would be the beginning of Microsoft!

When IBM created a new category, the PC, Microsoft surfed it. Indeed, by the early 1990s, IBM had lost the lead on the PC market since many other players had entered the space by commoditizing the hardware (the price of PCs was lowered substantially by competition, and so were margins).

On the other hand, Microsoft came out in the 1990s, as the undisputed leader, as it offered the underlying operating system that powered up most of the PC market.

And on top of that, over the years Microsoft launched a set of applications, that run on top of its operating system (what would evolve into the Windows Office Package), Microsoft created a suite of premium software services, and it built a distribution power that would be used later on to also try to take over the next wave of the Internet.

The commercial killer application of the Internet: browsing

Back in the mid-90s, the Internet was taking over. However, the Internet was still quite limited, it comprised a few million users and its killer commercial application turned out to be browsing.

As we saw, on the one hand, Microsoft had become the standard software company for the PC market, dominating most of the market. And the Internet did develop on top of the PC industry. There were though other players who dominated the first wave of the Internet.

In fact, by the late 1980s, and the early 1990s, internet service providers had taken off. Those comprised companies like AOL, which was among the major players by the early 1990s.

Those, though, offered access to proprietary services, at a fixed, monthly price. And beyond a certain threshold of data consumed, users could pay additions, on top of their subscription.

These proprietary networks weren’t the Internet. In fact, by the early 1990s accessing the Internet was still extremely technical, hard, and primarily for geeks and early adopters.

Things started to change swiftly when browsers came to market. The first major browser, Mosaic, turned out to be an incredible success. The group of students behind the development of Mosaic, would leave and build a company on their own: Netscape.

Netscape would represent the first major Internet player. It dominated the browser market, and it turned out to be the commercial killer application of the Internet. Finally, the Internet, which was hard to access before, was easy to access now, thanks to the browser.

As Netscape became a success it also created a sense of urgency for Microsoft to start moving fast, in developing its own browser. Thus, Microsoft licensed the first version of its browser from the NCSA. NCSA was a research unit at the University of Illinois Urbana-Champaign, which enabled the development of Mosaic.

In short, to kick off its browser, Microsoft took the code of Mosaic, which had been developed by the team, who later had developed Netscape, the main Internet competitor of Microsoft at the time.

That is how Microsoft launched its browser: Internet Explorer.

Microsoft bundled its browser within its Windows package, thus leveraging its dominant position to quickly kick start its Internet operations. The strategy worked out successfully. In 1994-5 Netscape had the most market shares in the browser industry. By 1997-8 things had shifted.

Thanks to its firepower, Microsoft’s Internet Explorer had taken over most of the shares of the browser industry. In fact, while initial users might have cared about the technical aspects of the browser, preferring the Netscape approach to Microsoft.

Later on, as the Internet user base grew exponentially, the additional users coming in were looking more at a frictionless experience, than anything else. And having Internet Explorer available by default on their PCs, just made it straightforward for them, to use it.

This strategy worked so well, that it also attracted the attention of regulators, that by the early 2000s, engaged in an antitrust case against Microsoft. This was the context of the late 1990s when we had the so-called “browser wars.”

The commercial killer application of the Web: search

Once browsers had become established, this industry opened up the way to a whole new set of players. Among them, were search engines. While search engines had developed throughout the 1990s, the real commercial breakthrough came when Google (initially called BackRub) came late to the game and yet it dominated it.

Launched as an academic project in 1996, it became a company by 1998. Google, which entered the search engine market relatively late (it was the 18th search engine to launch on the market), also gained traction quickly.

With the right product, which improved many times over existing alternatives, with the right distribution (as we’ll see Google managed to secure key deals, like the one with AOL), and the right venture capital deals (Google was backed by Sequoia Capital and Kleiner Perkins) the company took off.

To be sure, initially, the path wasn’t straightforward, and Google’s founders, by 1999, were still looking to go back to their PhDs (in short, they still considered Google as an academic project) and looking to sell it for less than a million dollars!

In the meantime, other players, like GoTo.com (renamed Overture), dominated the market. Yet when Google came to market, it turned out to be an incredible solution, more advanced than existing alternatives, and able to index an exponentially growing number of web pages.

Google represented the epitome of Web 1.0 which developed on top of the browser market. And it eventually found into advertising the business model that made it scale. Between 2001-and 2004 Google built the advertising machines (Google Ads and AdSense) which enabled the company to skyrocket its revenues, to these days.

The major innovation was the fact that Google managed to mix paying results with organic results. And at the same time, also offer a score for paying results. Thus, being featured on top of paid results wasn’t just a matter of how much budget you poured in (as it happened with other players like GoTo), but there was a quality score, determined by various factors which by time to time also ranked paid results.

Google became the king of Web 2.0

In the end, Google became the epitome of a second wave of the Internet, which would be called – in hindsight – Web 2.0. A web made of user-generated content, algorithms at scale, and platforms.

Google, which initially had grown thanks to a great product, a few great distribution deals, and the right source of capital and network (on the board of Google there were legendary venture capitalist John Doerr, and Google’s co-founders were very closely connected to Al Gore) managed to become the king of Web 2.0.

All the while, Microsoft could not stop Google from conquering most of the search market shares, as it had done previously with the browser market, by taking over market shares from Netscape.

Indeed, by 2004, Google’s advertising machine was complete, showing the strongest digital cash machine ever created (Google enjoyed and still enjoys margins never seen before).

And over the years, Google would successfully vertically integrate its supply chain! Thus, becoming the de facto standard, especially on mobile devices, where it controls the underlying operating system (Android), the browser (Chrome), the marketplace (Google Play), and the search engine, plus a suite of free apps offered on top of these devices, by default!

In 2021, Google generated over $257 billion in revenues, whereas Microsoft generated $168 billion.

Below is an in-depth overview of these early years, with a person that lived through the deal that created the Google that we know today!

How much is a brand worth?

Putting a $ amount on a brand is very hard. For a financier, a brand is something valuable but not essential. In fact, a financial analyst would take a practical approach. For instance, by looking at assets on a balance sheet (like patents and trademarks) and computing the overall value of those. Yet this would neglect the value of the interactions between those “intellectual properties” and the minds and people tied to the business.

For an accountant that is just a headache. That is why accounting methods have neglected it for hundreds of years and still do. In fact, often it’s possible to put a $ amount on a brand only when a company gets sold. Whatever surplus is left after the sales, accountants put it under the umbrella of “goodwill.” Almost like someone trying to hide dust under the carpet; when there isn’t a better place where to dump that.

For an anthropologist, the brand is all that is. In fact, he would go on to say how the value of your business over time will be based on how hard you worked in persuading people to believe in your company’s myth. The stronger the myth, the stronger the brand.

I like a holistic approach based on the one thing – I argue – that captures the value of a business in the long run: its business model!

The rise of attention merchants and asymmetric business models

Google was not the first search engine on the Internet. Quite the opposite, it was a latecomer, in a search industry already dominated by several players. Yet Google, not only was an incredible tool, with an incredible tech stack. It also innovated in its business model.

A key innovation Google brought was to build what I like to call and define an asymmetric business model.

To understand this, watch the video below:

The information at users’ fingertips

When Google went public in 2004, Larry Page and Sergey Brin put together a letter that clarified:

Sergey and I founded Google because we believed we could provide an important service to the world-instantly delivering relevant information on virtually any topic. Serving our end users is at the heart of what we do and remains our number one priority.

Our goal is to develop services that significantly improve the lives of as many people as possible. In pursuing this goal, we may do things that we believe have a positive impact on the world, even if the near term financial returns are not obvious. For example, we make our services as widely available as we can by supporting over 90 languages and by providing most services for free. Advertising is our principal source of revenue, and the ads we provide are relevant and useful rather than intrusive and annoying. We strive to provide users with great commercial information. (Source: abc.xyz)

Google has created the most powerful search engine that proved to be the most reliable alternative for users. In fact, each day billions of queries go through Google. People ask any question. From very practical questions like “how to tie a tie” to more existential ones like “why am I like this.” Users all around the world can rely on Google’s AI-powered algorithm to read and understand their queries.

Without that focus on providing a superior product, Google wouldn’t have become what it is today. However, that is the first part of the equation.

The long-term value is in the business model

We are often bound to believe – especially in tech – that it is all about the product or service you offer. I want to show you why that is not the case.

Take Apple; 50%+ of its revenues come from the iPhone.

Therefore, you might think that is what makes this company profitable in the long run. That is an oversight. What makes Apple sustainable in the long run it’s the hardware and software ecosystem it created around those products.

Take Google. You might think that since Google is the best search engine out there, that is why it makes 80% of its revenue from advertising. However, for how marvelous Google’s search algorithm is, what makes Google the tech giant that it is today; is its business model.

AdWords and AdSense together create a win-win-win. Companies can sponsor their products for much cheaper and track their results with no effort. Online publishers can easily monetize – something is better than nothing – their content. Users get relevant answers to any question they might have. A great product is a little part of the equation. The rest is about business modeling!

In fact, a business model is what helps companies capture value in the long run. If you do not have a business model, you might not have a business.

Google PPC in a nutshell

Back in 1999, it was already clear that Google was the best search engine out there. It wasn’t clear though, how it was supposed to make money. In mid-1999 Page and Brin met Bill Gross, founder of GoTo.com search engine.

Gross had an idea. Rather than rely on the old advertising model based on CPM or cost per mille – in short, advertisers would get paid on the number of impressions of an ad. Gross thought of a new model, based on CPC or cost-per-click. A company would pay for an advertisement only if a user found it so relevant to click.

At the time Page and Brin were still reluctant about using ads to monetize Google. Yet the company was burning cash, and by the year 2000 investors were getting nervous. When Page and Brin were approached again by Gross, which proposed to merge the two companies, Google’s founders declined.

Why? Because they didn’t want their search to be associated with a company that mixed paid advertising with organic results. Today Google generates over 88% from advertising, of which CPC is the primary driver.

In 2002 Gross sued Google for allegedly stealing its cost-per-click model.

Google AdSense in a nutshell

In 2003, Google’s employee Paul Bouchet developed a feature that allowed the matching of words sent through Gmail with keywords bidden by advertisers. That generated ad profits with the CPC model.

Sergey Brin thought why not to apply this model to websites. That is how they kicked off AdSense. In short, Google for the first time allowed small businesses and blogs to generate ad revenue on their own. In return, Google got one-third of the revenue generated. As Danny Sullivan put it at the time in the USA Today “it basically turned the Web into a giant Google billboard.”

Therefore, any “Web property” was a good candidate to become a Google partner and generate profits for their content independently from advertising middlemen. What’s the take here? I believe there are two main ones.

First, a business model well designed can make a business go from zero to a billion, just like it did with Google. Second, at times when a company grows at the size of what Google is today, it’s hard to remember that back then it was a disruptive force that “democratized” the web, allowing small blogs and small businesses to make money online!

A win-win-win Business Model

AdWords and AdSense combined made Google among the most powerful tech companies in the world. Of course, Google managed to get there because it was backed by great service, a search engine able to have you find any kind of information in a web made of billions of pages.

Yet, without such a powerful business model search engines today wouldn’t exist. Also, most if not all of Google’s existing applications (Google docs or Gmail to mention a few) wouldn’t exist if it wasn’t for the stream of revenues generated over the years by Google’s business model.

In other words, a well-designed business model has to create value for the stakeholders and not just for the shareholders. Google allows each day to billion people to find the answers they need. Businesses can enhance their revenues through AdWords by tracking their spending, conversion, and opportunities. Content creators can easily monetize their content by allowing Google to show targeted ads within their “web properties.”

That is how Google went from zero to over eight hundred billion of market capitalization!

What will Google’s business model look like in the future?

As of 2021, Google still got over 81% of its revenues from advertising. However, it is important to notice how other areas of the company are growing pretty quickly. For instance, the other part of the business focuses on App purchases through the Google Play store, the Google Cloud offering, and the Hardware product.

This shows how Google is investing in other areas that might well represent its main way of monetizing in the years to come. Another critical aspect to look at is Google’s “other bets” a set of risky, yet visionary attempts of Google to shape the future of humanity via technology. Will any of those be the next big hit?

The business model canvas can be used as a tool to dissect and understand others companies’ business models, and how they are positioned in the marketplace.

In this article, we’ll look at the Google business model canvas. Keep in mind that the business model canvas is just one of the frameworks you can use to build, design, or assess a business model.

Also, a business model canvas will capture where a company is or where it will want to be in the future. Thus, we’ll look at where Google’s business is at the time of this writing.

While a business model does create a long-term competitive advantage, being able to innovate it over time is critical. If Google itself doesn’t want to be disrupted, it will need to evolve its business model.

This might imply a complete change in a few years on a few things that comprise its business model according to the business model canvas like key partners, distribution channels, and customer relationships.

While the vision of a company might stay the same, other things like value proposition might change substantially.

Google key partners

Each day billions of people get online, and they “google things up.” For many of those people, Google is de facto the web. Yet it hasn’t always been this way. There was a time, back in the late 1990s when the web was called AOL.

Indeed, probably more than half of the traffic on the internet went through this portal. When Google launched, while it had figured out a great product and search engine, it didn’t have a business model yet.

For instance, by reviewing some of the thoughts of Google founders Page and Brin, it seems clear that they thought advertising wasn’t well suited for a search engine:

In the paper, they pointed out their “mixed feelings” about the advertising business model. As they believed any search engine based on the premise of advertising in a way went against its primary mission.

However, over time Google figured out a way to show advertising in a way that would not affect user experience.

Since the beginning traffic going through Google‘s digital properties (its search pages) has been a critical ingredient for its long-term success.

That is also why initially Google made a deal with AOL to be featured as a primary search engine on its portal, which gave it massive visibility.

AOL on its hand was offered such a good deal, and it also saw search as a secondary feature, that it couldn’t say no to Google. Therefore, while we give for granted the billions of queries – that each day – go through Google.

We miss the fact that Google had to build up a vast distribution network that each day guarantees this traffic. This isn’t a simple network, but rather a massive infrastructure worth billions of dollars each year.

What does this infrastructure look like? There are a few elements:

Partnership agreements

One example is the multi-billion dollar deal with Apple to have Google featured as a default search engine on Safari. Traffic doesn’t come from thin air; it comes from physical devices.

As the web has shifted from desktop to mobile devices, Google has developed its distribution strategy (for instance via Google Chrome).

However, a vast array of devices (take iPhones or iPads) are operated by Apple IOS operating system and its internet browser (Safari). To be featured on those devices Google pays a substantial amount of money.

Open handset alliance

As pointed out above mobile users have grown massively in the last decade. This implies that whoever takes hold of mobile content consumption can build a sustainable business model for years to come.

With other 84 technology and mobile companies, Google forged the Open Handset Alliance. In fact, in 2005, Google acquired Android (what would become the prevailing operating system for mobile).

Just a few months after the launch of the iPhone by Steve Jobs, Google announced its Open Handset Alliance. The aim was to build “the first truly open and comprehensive platform for mobile devices.”

The business model behind the Open Handset Alliance is a simple one. Google provides its free of charge, the operating system for mobile devices, Android, and in exchange for many apps, like Google Play and Google Chrome come pre-installed.

AdSense network

It wasn’t just traffic the critical ingredient for Google’s success. It could offer relevant and high-quality content compared to any other portal, or search engine.

On the one hand, Google had figured out how to offer relevant ads by introducing AdWords with its quality score. On the other hand, it needed to balance that with high-quality organic content from the web.

While Google did offer that by indexing the entire visible web, it managed to improve quite a lot when it offered to any publishers (independently from their brand) the possibility to monetize their content via the AdSense network.

Comprising millions of websites around the world; those websites allow Google to tap into their sites to place banners from businesses that want to advertise their services. Google shares the advertising revenues generated from those banners with these publishers.

Webmasters

A great payoff of Google is its ability to send qualified traffic to any site, based on searches people perform. For instance, if I search for “car insurance” on Google, I will find a few text-based ads on top of its search results.

At the same time, I’ll also find many other organic results, that didn’t pay a dime to be featured there. This is possible because Google has a massive index on the web, and if that content is relevant, it will be featured on Google‘s first page.

Being on Google‘s first page might turn in substantial income for those sites able to rank through it. In particular, web owners can submit their website via Google Search Console (a platform to monitor the indexing of a site) to control how Google sees the site.

This allows publishers – independently from being part of Google AdSense – to “control” their rankings vis Google organic search engine. Millions of webmasters each day help Google index their content, and make it easier for the search engine to keep a qualified index of the web!

Google key activities

Google’s mission is to “organize the world’s information and make it universally accessible and useful.”

This bold vision requires Google keeps innovating in the search industry, while it also looks forward to new ways the web is developing. From voice search, visual search, machine learning, and more.

Google needs to invest first of all in a robust and secure infrastructure that makes it possible for the company to handle each day billions of queries. This implies a few key activities:

- At a basic level, Google has to keep innovating its search algorithms. This alone requires substantial investments.

- As voice search is growing it is critical that Google keeps innovating by also offering new products. For instance, Google launched its new voice devices, such as Google Home, which compete against other tech giants, like Amazon’s Alexa and Cortana.

- Google still generated most of its revenues from advertising. A business model based on a single source of revenue might not be sustainable in the long run. That is also why Google is investing resources in betting in other areas that might lead to the next innovation.

Google’s value proposition

For a tech giant like Google, which has a sophisticated business model, based on a hidden revenue generation, there isn’t a single value proposition.

Instead, several value propositions will serve the purpose of keeping key partnerships that allowed Google to scale up and let it today to maintain its market dominance. Thus, if I had to summarize the fundamental value propositions those would be:

The value proposition for billion of users

Free search engine for billions of users around the world. This is how Google managed to grow quickly. A great, reliable, and free service that allowed users anywhere in the world to find the information they needed, fast.

Tools and productivity apps

Besides its free search engine, Google also offers a set of free tools and apps (to mention a few: Gmail, Google Analytics, Blogger, Google Books, Google Chrome, and many others). Those free tools are among the most used in the business world.

Google advertising business

The core of the Google business model is advertising, focused on targeted text-based ads for businesses offered via the AdSense network.

Before Google existed,d there was no way for marketers to know in detail all the conversion metrics of their ads. While Overture was the first in offering CPC advertising, Google managed to scale it up to massive levels.

Google AdSense

Before Google disrupted the advertising world and took over the digital advertising market, a few established publishers could make money via advertising.

With its AdSense network, Google also allowed small publishers to monetize their content.

In a way, it was a democratization of the digital advertising market, where anyone with the content that got the most eyeballs and attention could monetize it, independently from its brand.

Google AdSense is still an essential element of Google’s value proposition.

Google customer relationships

The cash cow for Google is its AdWords network, made of a growing number of businesses looking to sponsor their products and services. That implies two things.

First, Google needs to keep offering targeted ads that allow those businesses to generate leads. Second, Google is as worth as much as the qualified traffic it can generate.

This implies that Google needs to keep focusing on making sure that users go back to its search results pages. Indeed, even if users do not pay for Google search results, they are the products.

As any attention merchant, Google is selling back its attention. That means Google will need:

Salesforce able to support AdWords (now Google Ads) businesses

Offering the proper support to businesses part of the AdWords network requires a substantial investment in business development people able to expand the list of companies that join Google’s advertising network. This implies local initiatives, training, and support to those businesses.

Privacy

Companies like DuckDuckGo have built their business on Google’s weakness in terms of privacy. If those concerns are not addressed Google might be losing an increasing chunk of users, willing to switch because of privacy concerns

Google customer segments

In terms of value creation, with its massive business model, Google has several “customers” not intended only for businesses paying Google for service but also for those people or organizations that contribute to Google’s financial success. In that respect we have:

Free internet users

Internet users around the globe. Even though Google is a free service, Google’s users are among the most important “customers.” If Google lost them, there would be no business at all.

Agencies, marketers, and businesses

Those who are bringing big bucks to Google are agencies, marketers, and businesses part of its Ad Network. They are driven by the fact that Google is an incredible source of targeted, and qualified traffic.

Publishers

AdSense Network Members allow Google to offer targeted ads on its web properties.

It is important that Google keeps offering those publishers enough incentives to keep monetizing their content via the AdSense platform.

I treat them here as “customers” because Google still needs to “convince” them to use the AdSense platform to monetize their content.

Google key resources

Even though Google is a digital business, that might make you think the company has no real assets. This is far from the truth.

As a reference, in 2017, Google had $7.2 billion of contractual obligations, primarily related to data center operations, digital media content licensing, and purchases of inventory.

This is to have you understand, also for a software business, to run the key asset, it takes a substantial amount of resources.

This implies a few key resources:

- The most basic thing of any site with a large number of traffic needs is a massive server infrastructure. Back in the late 1990s when Google was still in the very initial stage at Stanford, it brought down its internet connection several times, by causing several outages. That allowed its founders to understand they needed to build up a solid infrastructure on top of their search tool. Today Google has a massive IT infrastructure made of various data centers around the world.

- Another element to allow Google to stay on top of its game is to keep innovating in the search industry. Maintaining, updating, and innovating Google’s algorithms isn’t inexpensive. Indeed, in 2017 Google spent over $16.6 billion on R&D, which represented 15% of its total revenues.

Google distribution channel

I believe that one of the vital ingredients to Google’s success was its distribution strategy, during its first few years of operations. That is also why Google relies on:

- global sales team which uses business development to keep growing Google operations

- Google deals and partnerships that bring it to billions of devices in the world

I’ve extensively covered Google’s distribution strategy below:

- The Deal That Made Google The Tech Giant We Know Today

- Why Google Success Was The Fruit Of Its Business Distribution Strategy

Google cost structure

With its over $110 billion in revenues in 2017, Google reported $12.6 billion in net profits. This implies a few critical items in its income statements:

- traffic acquisition costs are a crucial metric to assess Google’s ability to generate value over the years:

TAC stands for traffic acquisition costs, and that is the rate at which Google has to spend resources on the percentage of its revenues to acquire traffic. Indeed, the TAC Rate shows Google’s percentage of revenues spent toward acquiring traffic toward its pages, and it points out the traffic Google acquires from its network members. In 2017 Google recorded a TAC rate on Network Members of 71.9% while the Google Properties TAX Rate was 11.6%.

- As we’ve seen R&D costs represented 15% of its total revenues, or $16.6 billion

- Sales and marketing represented 11.6% of its revenues or almost $13 billion

- Datacenters costs also represent another good chunk of Google’s cost of revenues

Google revenue streams

Google’s business model can be broken down into three main lines:

- Google advertising network

- Google’s other revenues (consisting of Apps, in-app purchases, and digital content in the Google Play Store; Google Cloud offerings and Hardware)

- Google other bets

Where’s Alphabet going in the coming decade?

Let’s explore now some areas where Alphabet might focus in the coming 5-10 years.

Next five years of search in business

- Continuous growth and improvements: Google, the search engine is still the primary short-term investment for the company, which requires substantial maintenance, and a huge engineering team. Google will keep improving its search engine, at scale, testing new features, algorithms, and more. While Alphabet is a large tech player, it still behaves (at the engineering level) like a startup, performing thousand of large experiments each year, and probably hundreds of thousands if not millions of tiny experiments each year.

- Mobile-first search: Google has been focusing on becoming mobile-first for years, and now this transition is almost complete. Apps like YouTube are already mobile-first. Search still follows a different logic on desktop, then on mobile, many websites from which Google borrows content, indexes it and ranks it, are still far from being mobile-friendly. Thus, this transition is still ongoing and it might still take a few years.

- Further expanding the user base: the pandemic further expanded the adoption of Google at a massive scale. Google managed to stabilize this growth trajectory and also to monetize it. In terms of adoption, if Google is able to transition from pull to push (see below), it will further expand its user base across the world.

- AI-driven algorithms at scale: Alphabet is also an AI-first company. Meaning that also its products, like Google and YouTube use many AI algorithms for various reasons. From indexing, and ranking, to advanced features. For instance, Google is experimenting more and more with content generated automatically at scale. In addition, starting in 2016, going forward, some Google search features have become predominant. Features like answer boxes, People Also Ask, enriched (rich) results, and more. Google is changing its logic, and it’s moving from pull to push platform.

- From pull to push: Google is moving from a search box mechanism to a news feed-like experience. Platforms like Google Discover, Google News, and Google Travel might become the rule of thumb. While the search box might always be there, its importance might shrink over the years. In fact, as part of Google’s plan to further scale globally, it needs to serve content in a proactive way to users, based on their preferences. This might make this “push mechanism” much larger than the classic search mechanism. Thus, in the next 5-10 years, while still important, the search might become a sub-set of a much larger information market online, dominated by advanced news-feed-like features and products.

- From publishing to web apps: the transition that helped Google become a tech giant, was an ecosystem made of users performing searches, websites/publishers publishing content, and companies bidding on keywords. Going forward, Google might become more and more an interface for developers. In short, as Google continuously changes its search results, and algorithms, this also requires websites to adapt to a dynamic framework. So where before it was about publishing content only, going forward, it might be way more about building dynamic websites, that beyond content also comprise customizations for users. This might make SEO become more and more a technical game.

- Hardware: will Google keep building smartphones? It probably will, and in a mobile market that is still the primary mass consumer platform, Google might finally get a big hit. The Google Pixel is already a great phone, and one of the future releases might give Google space to expand its hardware market share quickly. In the end, mobile is still the main platform for mass consumers, and it’s the place where Google controls the whole pipeline (for Android-based devices).

- A private version of Google? As privacy concerns arise, not only it might make sense for Google to buy a privacy-based alternative. It might also make sense to offer a private search alternative, even though this would be problematic to its business model in the short term.

- Business acquisitions? Definitely, acquisitions in spaces adjacent to search, AI, AR, and more will happen in the coming five years. But they might not be huge acquisitions, as Alphabet is under the radar of regulators.

Five years bets adjacent to search

- VR: where companies like Facebook are betting their future on VR. Google/Alphabet might play this game for the sake of AR. Indeed, where Facebook (Meta) wants us plugged into The Matrix so it can monetize our digital selves. Google might still want to monetize our attention, but in a mixed reality, where our productivity in the real world is enhanced through augmented reality devices.

- AR: Google has been the first commercial player to launch an AR headset. It was back in 2013-4 when Google launched its Google Glasses, and it was a huge failure. Yet, what many people don’t know is Google Glasses have survived for years, as an enterprise product. And now Google is revamping its efforts to try to create a hit product in the space and bring us toward a mixed reality world vision, in line with Alphabet’s vision.

Ten years bets beyond search

The moonshot factory bets are those that go way beyond search. It is hard to know whether they will work, and if one of them does, it might potentially build a whole new journey for Google/Alphabet. Let’s see some of these areas.

As discussed in Google’s bets, some of the key investments that the company made are:

- Access

- Calico

- CapitalG

- GV

- Nest

- Verily

- Waymo

Thus these areas comprise:

- Smart Home Devices (Nest) and Virtual Assistants (Google Home and more) and wearables.

- Quantum computing.

- Mobility, transportation at scaler, and self-driving.

- Robotics.

- Renewable energies.

What organizational structure does Google run?

Google (Alphabet) has a cross-functional (team-based) organizational structure known as a matrix structure with some degree of flatness. Over the years, as the company scaled and it became a tech giant, its organizational structure is morphing more into a centralized organization.

Is Google the largest player in the digital advertising space?

Google is the largest digital advertising player.

For instance, in 2022, Google search generated over $162 billion in revenues, and YouTube ads generated over $29 billion.

Google was followed by Facebook/Instagram, which generated over $113 billion in digital advertising revenues in 2022.

Also, growing fast, there are other players like Amazon ads, which generated over $37 billion in 2022, and TikTok, which, while it generated only about $11 billion, it’s growing very, very fast!

And now, with the release of the new Bing, and the partnership between Microsoft/OpenAI, competition is getting stronger.

Who are Google’s competitors?

Google, now Alphabet, is a tech giant with many moving parts which operate in various industries. From the advertising business to the cloud and hardware business, together with other bets.

Let’s look at the competitors of Google as a search engine. The main ones, comprise digital advertising players like Facebook/Instagram (part of the same company, now rebranded Meta), Bing, Yandex, and Twitter, Yahoo, TikTok.

Read Also: How Does Google Make Money.

Free Guides:

- Business Models

- Business Model Innovation

- Product-Market Fit

- Digital Business Models

- Sales And Distribution Lessons

- Business Development

- Market Segmentation

- Marketing vs. Sales

- Distribution Channels

Facebook is social media. Google is Search!

Last time, I said Facebook has proven the theory of platform business models right (it states that exponential growth would be possible due to the indirect network effects). Google has proven it even more (and a few years prior to Facebook).

Have you wondered how today’s world (ok, let’s say the internet) would look like without Google? The early homepages for millions of internet users were portal (or tabloid)-type pages, where search was only one of the features often buried among a lot of clutter. Other prominent pages also adopted the portal-style design (here Yahoo 1994, and 1997), or just look at the current AOL.com.

When Google emerged, their pages looked very bare. They focussed only on one value proposition: search results and reduced all search and transaction costs involved (it is said that this was due to the fact that they did not know enough about webpage design but seems it was to their advantage).

Portal-type pages are gatekeepers that channel traffic in desired directions through “internet traffic lanes” consisting of a system of links. A good search engine that is not prone to manipulation or bias can still be seen as a gatekeeper but is much less so than a portal-page.

Prior to the internet, buyers had to contact Yellow Pages or search offline for local or small businesses. Economic theory says by reducing search time, cost and efforts, Google unlocked new demand. The free search services provide value to businesses and users by matching them. Advertising then piggy-backs on this service but typically presents search-related results and constitutes most of Google’s revenue (>80%).

“Our mission is to organise the world’s information and make it universally accessible and useful.” Google

Our focus will largely be on Google Search and the many tools closely related to it. The main exclusions are Google Cloud (see my article on Amazon Web Services to understand Cloud) and the related Internet of Things gadgets (see my Amazon Alexa personal assistant and IoT article on the topic).

Overview

This articles is structured in line with the elements of the business model canvas:

- Value proposition

- Key partners

- Key activities

- Key resources / assets

- Customer segments

- Channels

- Customer relationships

- Revenue

- Cost structure

Revenue

Revenue by type (segment)

Though Google has a lot of products that generate revenue, they only split those out that start making some notable revenues (in some cases, they delay reporting on individual products to keep it as a trade secret). The bar for reporting revenues separately is high.

Google’s total revenues as of December 31 2019 are $161.9b. Major revenues are as shown below. Note, that the parent company is Alphabet but as you can see below, most revenues are generated by Google (who also own YouTube).

| Google Search & other ads | $98,115 m |

| YouTube ads | $15,149 m |

| Google Network Members’ properties | $21,547 m |

| Google Cloud | $8,918 m |

| Google other * | $17,014 m |

| Other Bets revenues | $659 m |

* Includes YouTube non-advertising revenues

Revenue by geography

Revenue by geography is determined by the address of the (advertising) customer. Geographically, Google (Alphabet) reports user metrics and revenue for:

- Global

- US

- Europe, Middle East, Africa (EMEA)

- Asia-Pacific (APAC)

- Other Americas

Value Proposition

Platform business models need to think about the value proposition to all sides of the multi-sided platform. You hear me say always that platform business models are about positive network effects as well as search and transaction cost reduction. Google is certainly the best example of the concept of search cost (as in search effort) reduction.

On a high level, the value proposition to users are (based on their own words):

- Organise (the world’s) information: through crawling and indexing and then matching with search queries

- Make information accessible: this includes making accessible things: search news archives, patents, academic journals, billions of images and millions of books (through scanning)

- Accessing information in most life situations: including on the go on their mobile (mobile-friendly pages will rank higher)

- Fast pace of search (and search result pages): millions of search results found within milliseconds. Their Chrome browser and tools are typically the fastest among peers including on mobile. Their desire for pace is uncompromising (compare MS tools that never get faster even if the underlying HW has exponentially gotten faster according to the old saying: “What Intel giveth, Microsoft taketh”)

- Clarity & simplicity: What may have started due to lack of HTML skills has become one of their biggest value proposition, clarity and simplicity of the start page and search results. Laser focus on usefulness

- User search experience: Fast, simple, clear, best ranking of search results without preference for ads which are marked as Ads

- Focus, esp no distraction through ads: Many search results don’t display any ads simply because no relevant ads are in the inventory. Ad quality scores aim to ensure display ads are relevant to the search

- Continued iteration and improvement: on various levels (see key activities)

- Democracy: “We assess the importance of every web page using more than 200 signals and a variety of techniques, including our patented PageRank™ algorithm, which analyzes which sites have been “voted” to be the best sources of information by other pages across the web” Google

Similar value propositions

There are over 39,000 businesses and startups on Crunchbase that fully or in part rely on Social Media functionality or have such an app. This easily exceeds the «games / gaming» category by 2x.

You could add to this related types of apps, such as user-generated content / media sharing, messaging, chat, search, vertical search, location-based search, review platforms among others and you’d probably end up at 100k+ businesses. Here’s an article that shows 95 social media apps as the tip of the iceberg.

I have covered these types of platforms / apps in several long articles: Google, Facebook, Twitter, Snapchat, Pinterest, Groupon, Yelp. It might be the most extensive resources on the internet on the business model of these companies / apps. And I am being contacted by many who feel that understanding these types of apps, platforms and functionality can drive the growth of their business:

“The content you have created is super valuable and really makes it clear how those large players are earning their money” Malin Andersson, Co-Founder Worldsmarathons.com (Purchaser Super Bundle).

Business model first: I appreciate we all love to design and develop. But the view that I have expressed many times is that the business model matters most. Developing randomly can cost you years. There are typical elements that you will see across all of these apps. But each of these businesses implements them somewhat differently.

Comparing the differences, similarities and results has been crucial in understanding what drives success (and what doesn’t). I have put all of this together in our social media / search super bundle. I am also providing learning aids that will help you to focus on the key parts in a way that can get you through it in a few hours time. Learn more here….

Key Partners

Google is a multi-sided platform with a large ecosystem of partners. Listed below are the “sides” of the multi-sided platform followed by the partners. The main focus is on the Google Search platform.

Sides of the multi-sided platform

- Users: The majority of users are searching and consuming content. A lot of users also use some or many of Google’s tools, such as GMail (1b users), Maps, the Android OS (2.5b users), etc

- Websites/blogs: Website owners create/curate content that Google crawls, indexes and presents as search results. Some sites stand out, such as Wikipedia who often get a featured box if Google thinks the user is looking for knowledge-type information. Other search-intents also lead to a tailored presentation of search results with some sort of content curation from relevant sites

- Brands: Large brands as such may not stand out as they do on social media. Their search results may appear higher in the search result if relevant, but there is no logo or anything. Exceptions are of course search-specific results presentation, think of shopping results if this anticipated as the search intent

- Businesses: Businesses – especially if registered in Google My Business – will be presented in a map

- Advertisers: Google presents ads up the top, provided it is considered relevant enough for the search. Ads on Google remain native, that also means they are very simple – often a simple text snippet. Advertisers can also add so-called ad extensions/call-outs (these can be additional links to relevant subpages, their phone number or other relevant information and more)

- Influencers, VIPs: influencers, VIPs, etc don’t as such get a lot of additional featuring. In some cases, you may find Tweetboxes being shown within the search results if this seems relevant to the search

- Media/News: News results also play an important role in the search platform. This becomes clear if you look at the search result autocomplete feature which can often feature keywords of breaking news. News has its own section with results often from the big media outlets or online magazines

- Creators / publishers: YouTube has a lot of creators who can make money from ads. On the Search platform, videos have their own section (it does not only show YouTube video in those results)

I see the above as relevant enough to call them a separate side. You can call them a key partner but I think a “side” of a multi-sided platform is actually a bit more than that.

Here are what we would more ordinarily understand as key partners:

- Customer service partners: Google partners provide services for the various aspects of marketing, some examples are (there is certainly an overlap with SEO partners):

- Search Advertising

- Video Advertising

- Display Advertising

- Shopping Advertising

- SEO partners: There is a large industry of Search Engine Optimisation partners that support website creators to attract more and better traffic. The industry is poised to reach $80b in 2020

- Developers: Google is highly revered among developers. They offer many ways for developers to get in touch:

- Thousands of communities directed towards students, professionals, entrepreneurs, women. Examples are: local Google Developer Group (GDG) chapters, Developer Student Clubs (also hundreds of them globally, Launchpad: global accelerator programs

- Groups organised around technologies (or consoles): Google API, Google Cloud, Google Play, Firebase, Chrome and more

- Roughly a dozen events per years centred around a technology